Shop / calculated industries calculated industries3405

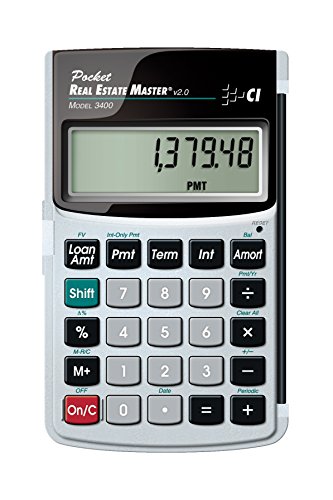

Real Estate Mortgage Finance Calculator for Buyers | Calculated Industries 3430 Qualifier Plus IIIfx | Easy-to-use Keys | Pre-Qualifying, Payments, Amortizations, ARMs, FHA/VA

Add to wishlist

Category: calculated industries calculated industries3405

About this item

- SPEAKS YOUR LANGUAGE with keys clearly labeled in residential mortgage finance terms like Loan Amt, Int, Term, Pmt; this industry-standard calculator is super easy to use on all realty financing matters from finding a loan that works for your client to considering trust deeds investments, or finding remaining balances or balloon payments and more

- DEDICATED BUYER QUALIFYING KEYS let you enter client’s income, debt and expenses to pre-qualify them to only show properties they can afford. Include tax, insurance and mortgage insurance then compare loan options and payment solutions to give your client choices before they make an offer to buy

- ASSUREDLY AND SIMPLY ADDRESS your clients' financial inquiries, regardless of whether they are purchasers, vendors, investors, or tenants. Enhance your stature as an emerging agent, a veteran broker, or a knowledgeable loan officer. Finalize more property transactions and wow your clients with prompt, precise responses to all their queries related to real estate finance, spanning from PITI Payments to IRR, NPV, and Cashflows.

- BECOME AN 'INVALUABLE' RESOURCE to your clients by reducing their confusion and uncertainty; ensuring they are able to make a purchase offer; knowing they can afford the down payment; and determining which is the right loan for them. Date-math for listings and contracts too. Comes with a protective slide cover, quick reference guide, pocket user's guide, long-life battery, 1-year

- FIGURE OUT THE RIGHT LOAN for your client at the press of a button for jumbo, conventional, FHA/VA, or even 80: 10: 10 or 80: 15: 5 combo loans; check to see if ARMs or bi-weekly loans, quarterly payments or if interest-only payments are the answer; giving your client more choices; easily perform “what if” loan or TVM calculations – find loan amount, term, interest or PITI or PI payments